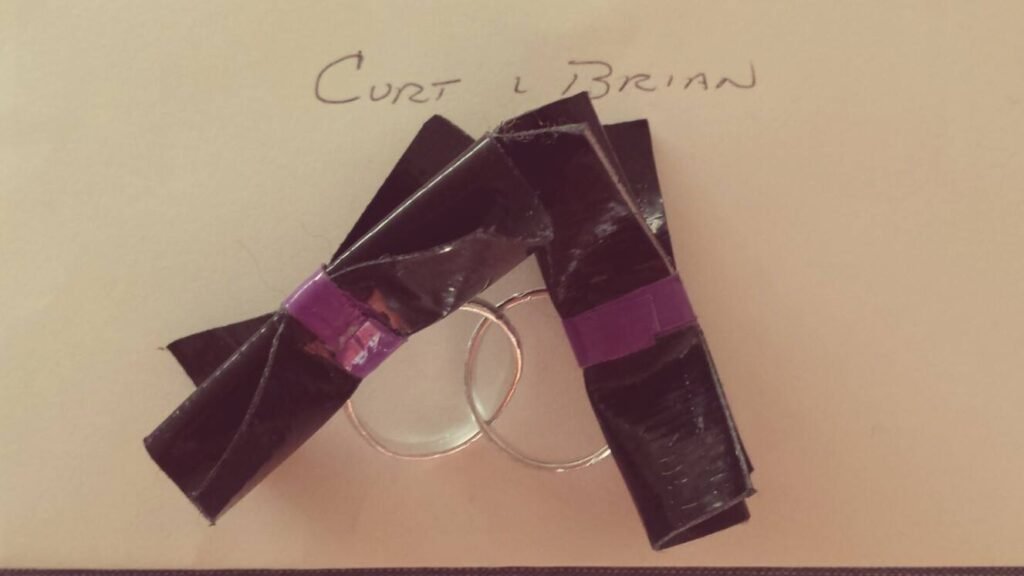

Our marriage rights are not secure

I read this article on the Advocate by Trudy Ring titled “South Carolina venue hosts free LGBTQ+ weddings in show of support and protest.” The event itself is a great act of solidarity, and it’s nice to see events like this in places like South Carolina and, frankly, any red state. But if we step back and look at the bigger picture, we have to ask: Why was this necessary in the first place? And what does it mean for us moving forward?

Marriage Equality is Still Fragile

I don’t think most straight people realize just how vulnerable our right to marry really is. Many of us in the LGBTQ+ community know, deep down, that it could be a temporary right – one that can be taken away from us. Legally, we’re standing on shaky ground. The Supreme Court’s decision in Obergefell v. Hodges granted us marriage equality, but it didn’t guarantee permanence. Unlike constitutional amendments, Supreme Court ruling can be overturned. This one is particularly vulnerable to their revisiting it an overturning it.

The Attacks on Marriage Are Real and Ongoing

The attacks on marriage are coming from both the state and federal governments. As the article pointed out, states like Idaho are actively trying to dismantle Obergefell through the court system. And in states like Texas, laws against same-sex marriage were never repealed; they remain on the books and would go back into effect the moment Obergefell is overturned. At the federal level, we already know that the current Congress will take away our rights if they get the chance. What we don’t know is how the Supreme Court would rule if given the chance to reconsider marriage equality. Before the election, I had some hope that a majority could be crafted to uphold marriage equality. But now, I’m pretty sure they’ll overturn if/when it they get the chance. The risk feel very real.

The Legal and Tax Fallout – What happens if Obergefell Falls?

If marriage equality is overturned, what happens next? Would states be allowed to ignore legally recognized marriages? Would LGBTQ+ people have to go start filing as single taxpayers again for both federal and state purposes? How would benefits, health care, and inheritance laws be affected? Let’s take a closer look at these items.

1. Federal and State Tax Filing Status

Currently, married LGBTQ+ couples file as Married Filing Jointly (MFJ) or Married Filing Separately (MFS), allowing access to tax benefits like:

- Lower tax brackets for joint filers

- Higher standard deductions

- Access to spousal IRA contributions

- Favorable treatment of capital gains and estate transfers

If Obergefell is overturned, states that reinstate same-sex marriage bans may refuse to recognize these unions, forcing affected couples to file as single taxpayers at the state level. In the worst-case scenario, if Congress follows suit, they could attempt to strip marriage benefits at the federal level as well—requiring LGBTQ+ couples to file as single, even for federal taxes.

2. Estate & Gift Tax Issues

Married couples benefit from the unlimited marital deduction, allowing them to transfer assets to their spouse tax-free during life and at death. If marriage equality is reversed, LGBTQ+ couples may be treated as unmarried individuals, meaning:

- No automatic spousal inheritance rights without a will or trust

- No unlimited marital deduction for federal estate tax (which has a 40% rate on amounts exceeding the exemption)

- Potential exposure to state estate and inheritance taxes

- The need for additional estate planning tools (e.g., trusts, joint tenancy) to protect assets

3. Social Security & Retirement Benefits

Currently, spouses are eligible for:

- Social Security spousal and survivor benefits

- The ability to roll over a deceased spouse’s IRA or 401(k) into their own without triggering required distributions

- Access to spousal benefits under employer pension plans

If states stop recognizing same-sex marriages, could those states deny LGBTQ+ surviving spouses access to Social Security benefits? Could employer-sponsored retirement plans stop recognizing LGBTQ+ marriages in certain jurisdictions? These are unanswered questions, but they highlight the uncertainty we could face.

4. Health Insurance & Employment Benefits

- Employers offering spousal health benefits could have the legal ability (or even the mandate in some states) to deny coverage to same-sex spouses if marriage bans come back.

- COBRA continuation coverage, typically available to surviving spouses, might not apply to LGBTQ+ spouses in states that no longer recognize their marriage.

5. Adoption & Parental Rights

- Joint adoption rights may be revoked, affecting tax credits like the Adoption Tax Credit and child-related deductions.

- Non-biological parents could lose legal recognition, complicating tax dependency claims for their children.

Some people point to the Respect for Marriage Act as a safeguard, but let’s be clear: it’s not enough. It was a necessary step, but it only requires the federal government and states to recognize existing marriages – it doesn’t force states to issue new marriage licenses. And since it’s only an act of Congress, it can be repealed just as easily by a future Congress.

The truth is, we don’t know exactly how this would play out. The legal and financial chaos would be enormous. For now, all we can do is prepare: Think through our options, understand the risks, and have a plan for how we will respond.

What Can LGBTQ+ Couples Do to Prepare?

While we can’t predict exactly how things will unfold, there are steps LGBTQ+ couples should consider now to protect themselves financially:

✅ Ensure your estate plan is airtight – Wills, trusts, and durable powers of attorney are crucial.

✅ Consider making large financial gifts now – While you still qualify for the marital deduction.

✅ Explore legal agreements – Domestic partnerships, cohabitation agreements, and contractual arrangements may be needed.

✅ Stay informed and be ready to adapt – The tax landscape could shift quickly, requiring proactive planning.

Events like the one in South Carolina are inspiring, but the highlight the urgency of the moment. The fight for marriage equality isn’t over just because we won a Supreme Court decision in 2015. If anything, that victory put a target on our backs. We need to stay engaged – advocating, voting, and making our voices heard – because if we don’t, we may wake up one day to find that our rights have been rewritten out of existence.